What Past Recessions Tell Us About the Housing Market

It doesn’t matter if you’re someone who closely follows the economy or not, chances are you’ve heard whispers of an upcoming recession.

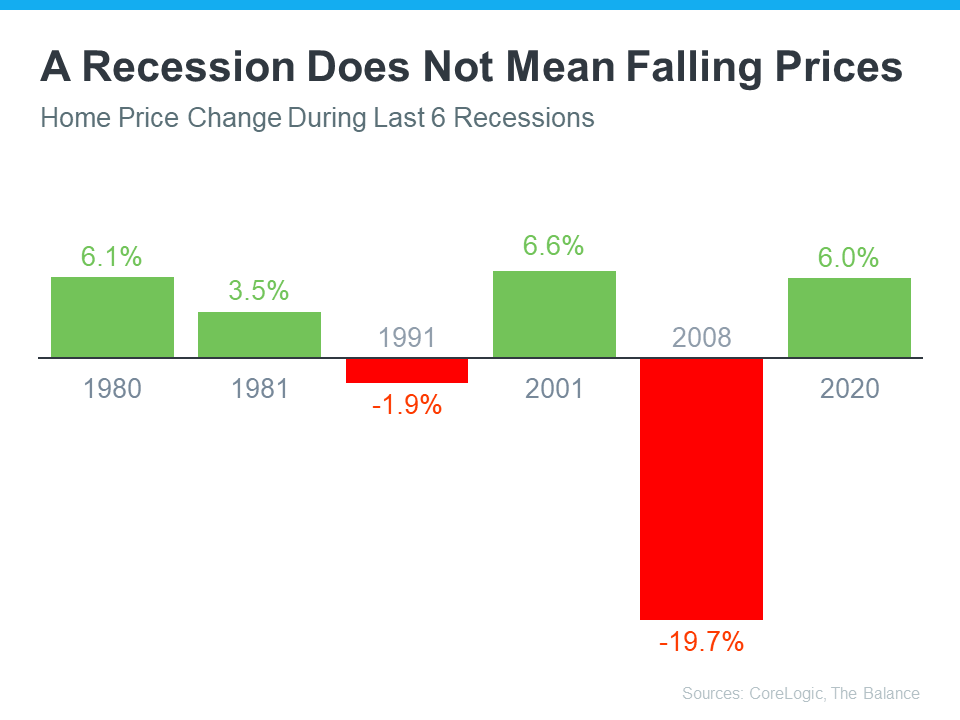

A Recession Doesn’t Mean Falling Home Prices

To show that home prices don’t fall every time there’s a recession, it helps to turn to historical data. As the graph below illustrates, looking at recessions going all the way back to 1980, home prices appreciated in four of the last six of them. So historically, when the economy slows down, it doesn’t mean home values will always fall.

Most people remember the housing crisis in 2008 (the larger of the two red bars in the graph above) and think another recession would be a repeat of what happened to housing then. But today’s housing market isn’t about to crash because the fundamentals of the market are different than they were in 2008. According to experts, home prices will vary by market and may go up or down depending on the local area. But the average of their 2023 forecasts shows prices will net neutral nationwide, not fall drastically like they did in 2008.

A Recession Means Falling Mortgage Rates

Research also helps paint the picture of how a recession could impact the cost of financing a home. As the graph below shows, historically, each time the economy slowed down, mortgage rates decreased.

Fortune explains mortgage rates typically fall during an economic slowdown:

“"Over the past five recessions, mortgage rates have fallen an average of 1.8 percentage points from the peak seen during the recession to the trough. And in many cases, they continued to fall after the fact as it takes some time to turn things around even when the recession is technically over.”

In 2023, market experts say mortgage rates will likely stabilize below the peak we saw last year. That’s because mortgage rates tend to respond to inflation. And early signs show inflation is starting to cool. If inflation continues to ease, rates may fall a bit more, but the days of 3% are likely behind us.

As Per us KeithGo Lending Team

While history doesn’t always repeat itself, we can learn from the past. According to historical data, in most recessions, home values have appreciated, and mortgage rates have declined.

If you’re thinking about buying or selling a home this year, let’s connect so you have expert advice on what’s happening in the housing market and what that means for your homeownership goals.