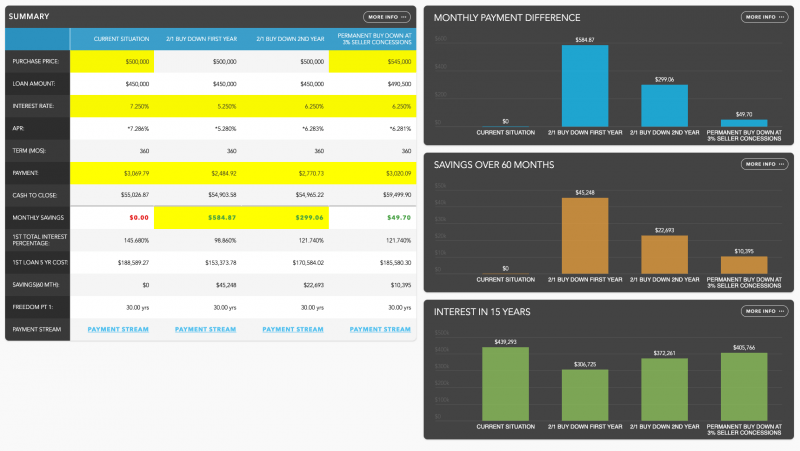

Hello everyone!! Ok, so here is a scenario that has been coming up a lot. We're seeing these terms being used with listings, and we're using these terms when negotiating between buyers and sellers in this market. Many lenders are coming out with a 2/1Buy Down. I want to show you the 2/1 buy down vs. permanent buy down and will give some reasons as to why the permanent buy down will help buyers in this market. I will go through both options, and how they work.

2/1 Buy Down:

How it works: In this scenario the Buyer is locked at current pricing (lets say 7.25%), but receives a 2%(5.25%) rate reduction the first year and a 1%(6.25%) rate reduction the second year. The third year the buyer pays the full amount of the mortgage at the rate they were locked in at (7.25%). The seller pays the difference in interest for the 2 years, this amount is deposited into an escrow account. When the Buyer makes a mortgage payment the money in the escrow account covers the difference between the rate reduction payment and the full payment the Buyer was locked in at.

Pros:

* Buyer gets a lower payment for the first 2years

* If they refinance before the 2 years the money in the escrow account is applied to the principle, so they don't lose out on any concession money

* Helps with cash flow for investment properties (certain terms apply, as 2% is max concession on investment properties)

Cons:

* Must be seller financed

* You are qualified and approved on the LOCKED IN rate (in this case 7.25%)

* Does not bring down DTI (debt to income ratio).

The biggest issue we face right now is affordability, and although 2/1 buy downs help with payment, it does not help buyers increase their purchasing power that was lost with the increase in rates.

Permanent Buy Down:

How it works: This is simply using seller concessions to pay for discount points for the Buyer. The money from the seller goes directly to a permanent buy down on the interest rate give you a lower rate and payment for the life of the loan.

Pros:

* Seller can contribute up to the maximum concessions (based on down payment) towards the buy down

* The buy down rate IS the rate used to qualify and approve the Buyer (This significantly reduces DTI, and helps clients purchasing power)

* Can help clients go conventional versus FHA (Due to high DTI)

Cons:

* Has to be seller financed due to High cost mortgage laws

* Not as great savings vs a 2/1 buy down initially

As you can see they both can have some benefits to clients. In this increasing rate market the biggest issue we face is affordability. With a permanent buy down we can help clients afford a higher priced home they wouldn't normally be able to afford in this market. On average a 1% decrease in rate equals about 40-45K in purchase power. I've seen the 2/1 benefit my buyers and I've seen the permanent rate buy down benefit my buyers. Each situation is unique, and each will have benefits when it comes to cost & savings.

I hope this provides some clarity, please reach out with further questions :)

Katie Stratford

2/1 Buy Down Vs. Permanent Buy Down - Lender LaunchPad