Blog Layout

Want To Buy a Home? Now May Be the Time.

There are more homes for sale today than at any time last year. So, if you tried to buy a home last year and were outbid or out priced, now may be your opportunity. The number of homes for sale in the U.S. has been growing over the past four months as rising mortgage rates help slow the frenzy the housing market saw during the pandemic.

Lawrence Yun, Chief Economist at the National Association of Realtors (NAR), explains why the shifting market creates a window of opportunity for you:

“This is an opportunity for people with a secure job to jump into the market, when other people are a little hesitant because of a possible recession. . . They’ll have fewer buyers to compete with.”

Two Reasons There Are More Homes for Sale

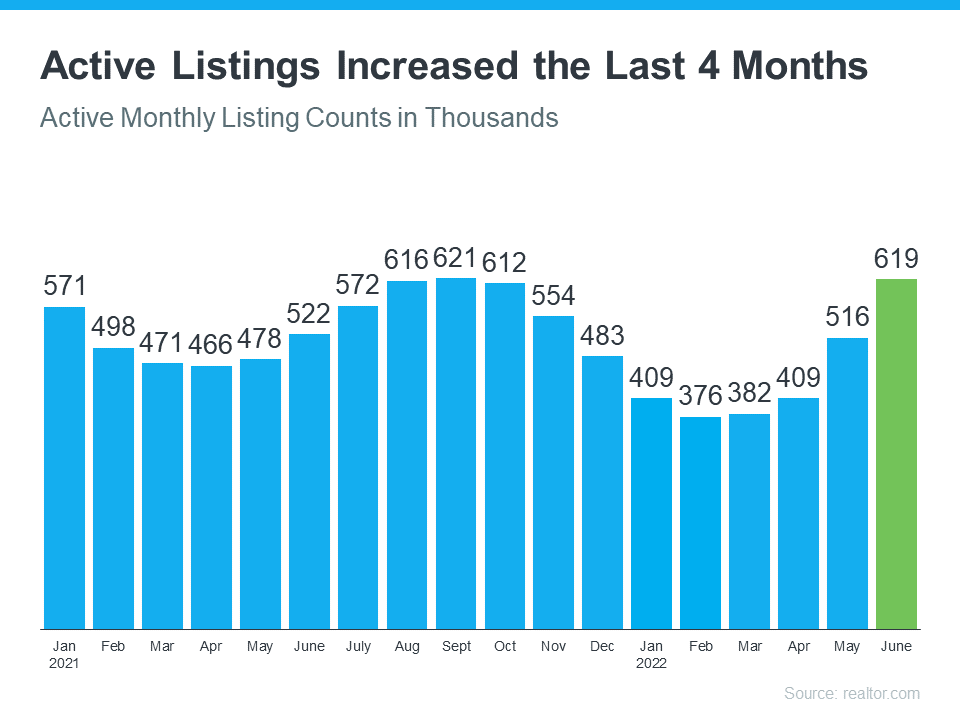

The first reason the market is seeing more homes available for sale is the number of sales happening each month has decreased. This slowdown has been caused by rising mortgage rates and rising home prices, leading many to postpone or put off buying. The graph below uses data from realtor.com to show how active real estate listings have risen over the past four months as a result.

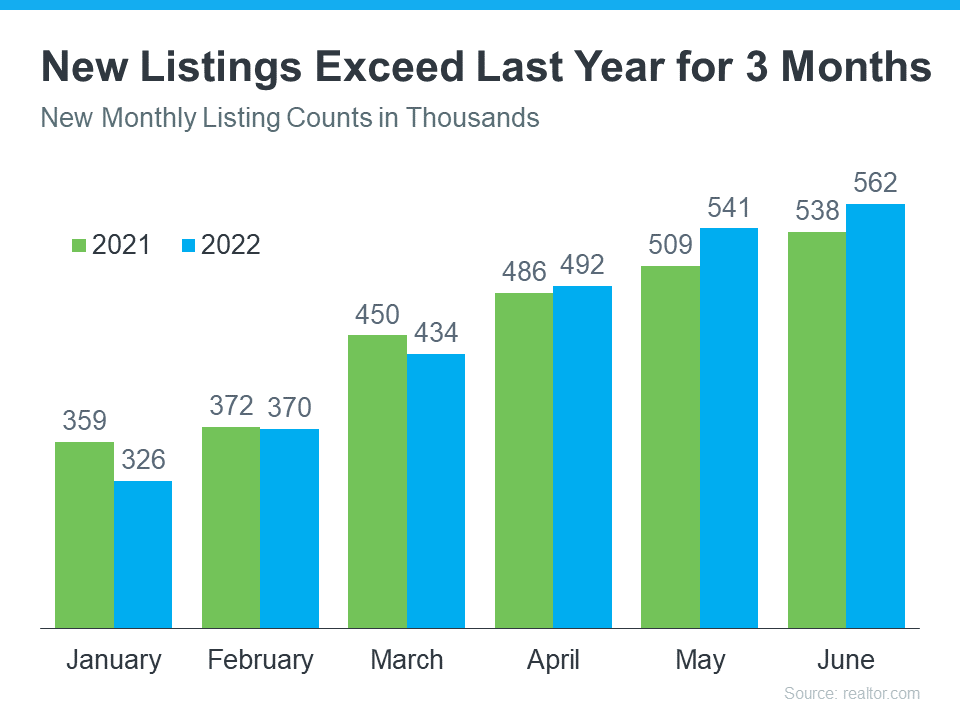

The second reason the market is seeing more homes available for sale is because the number of people selling their homes is also rising. The graph below outlines new monthly listings coming onto the market compared to last year. As the graph shows, for the past three months, more people have put their homes on the market than the previous year.

As per us at KeithGo Lending Team:

The number of homes for sale across the country is growing, and that means more options for those thinking about buying a home. This is the opportunity many have been waiting for who were outbid or out priced last year.

By Keith Goeringer

•

February 21, 2023

Why It’s Easy to Fall in Love with Homeownership! No matter how the housing market changes, there are some things about owning a home that never change like the personal benefits it can provide. When you own your home, you likely feel a sense of attachment because of the comfort it gives and also because it’s a space that’s truly yours.

By Keith Goeringer

•

January 4, 2023

Planning To Sell Your House? It’s Critical to Hire a Pro. With higher mortgage rates and moderating buyer demand, conditions in the housing market are different today. And if you’re thinking of selling your house, it’s important to understand how the market has changed and what that means for you. The best way to make sure you’re in the know is to work with a trusted housing market expert.

By Keith Goeringer

•

November 28, 2022

What Buyers Need To Know About the Inventory of Homes Available for Sale If you’re thinking about buying a home, you’re likely trying to juggle your needs, current mortgage rates, home prices, your schedule, and more to try to decide if you want to jump into the market.

By Keith Goeringer

•

November 23, 2022

Mortgage Rates Will Come Down, It’s Just a Matter of Time This past year, rising mortgage rates have slowed the red-hot housing market. Over the past nine months, we’ve seen fewer homes sold than the previous month as home price growth has slowed. All of this is due to the fact that the average 30-year fixed mortgage rate has doubled this year, severely limiting homebuying power for consumers. And, this month, the average rate for financing a home briefly rose over 7% before coming back down into the high 6% range. But we’re starting to see a hint of what mortgage interest rates could look like next year.